The Matthew J. Previte Cpa Pc Diaries

Table of ContentsRumored Buzz on Matthew J. Previte Cpa PcNot known Facts About Matthew J. Previte Cpa PcThe Buzz on Matthew J. Previte Cpa PcThe 8-Second Trick For Matthew J. Previte Cpa PcExamine This Report about Matthew J. Previte Cpa PcThe Matthew J. Previte Cpa Pc PDFs

Tax legislations and codes, whether at the state or federal degree, are as well complicated for many laypeople and they change as well usually for several tax experts to stay up to date with. Whether you just require a person to help you with your service revenue tax obligations or you have been billed with tax obligation fraudulence, work with a tax obligation lawyer to aid you out.

Fascination About Matthew J. Previte Cpa Pc

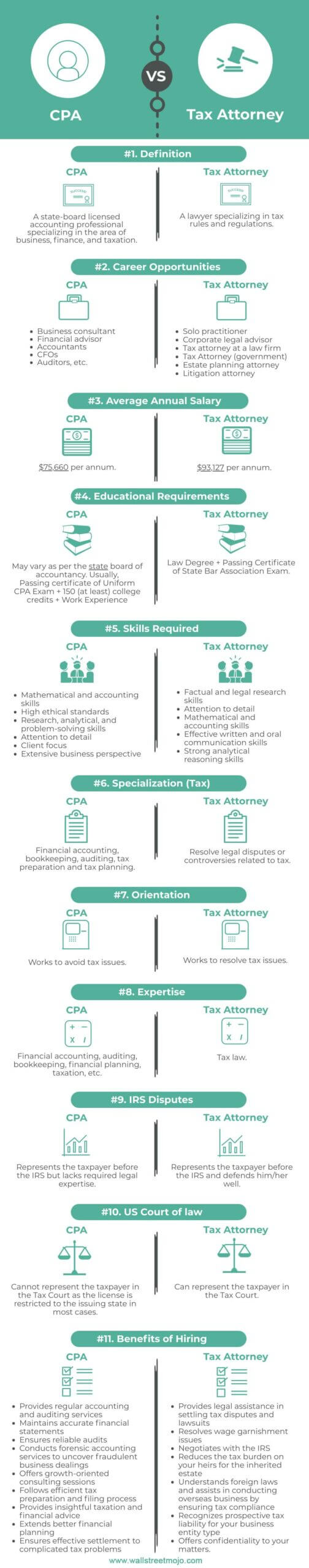

Every person else not just disapproval handling tax obligations, but they can be outright worried of the tax agencies, not without factor. There are a few concerns that are always on the minds of those that are taking care of tax issues, including whether to work with a tax obligation attorney or a CPA, when to work with a tax attorney, and We intend to aid respond to those concerns here, so you understand what to do if you locate yourself in a "taxing" scenario.

A lawyer can represent clients prior to the IRS for audits, collections and appeals but so can a CPA. The big difference right here and one you need to maintain in mind is that a tax attorney can provide attorney-client benefit, indicating your tax obligation lawyer is excluded from being forced to indicate against you in a law court.

A Biased View of Matthew J. Previte Cpa Pc

Or else, a certified public accountant can indicate against you even while working for you. Tax obligation lawyers are a lot more knowledgeable about the various tax obligation negotiation programs than a lot of Certified public accountants and know exactly how to pick the best program for your case and exactly how to obtain you qualified for that program. If you are having a trouble with the internal revenue service or simply questions and worries, you need to employ a tax obligation attorney.

Tax obligation Court Are under investigation for tax obligation scams or tax obligation evasion Are under criminal examination by the internal revenue service One more essential time to hire a tax obligation lawyer is when you receive an audit notification from the internal revenue service - tax attorney in Framingham, Massachusetts. https://www.giantbomb.com/profile/taxproblemsrus1/. An attorney can connect with the IRS in your place, be present throughout audits, aid work out settlements, and keep you from paying too much as a result of the audit

Part of a tax attorney's responsibility is to maintain up with it, so you are shielded. Ask about for a seasoned tax obligation lawyer and inspect the net for client/customer testimonials.

The 5-Minute Rule for Matthew J. Previte Cpa Pc

The tax lawyer you have in mind has all of the appropriate qualifications and testimonies. Should you employ this tax obligation attorney?

The choice to work with an IRS lawyer is one that should not be ignored. Attorneys can be very cost-prohibitive and complicate matters needlessly when they can be resolved fairly easily. In general, I am a huge proponent of self-help legal solutions, specifically given the selection of educational product that can be located online (including much of what I have published on the topic of taxes).

A Biased View of Matthew J. Previte Cpa Pc

Here is a fast checklist of the matters that I think that an internal revenue service attorney must be employed for. Let us be entirely truthful momentarily. Lawbreaker charges and criminal examinations can ruin lives and carry very serious effects. Any person who has actually invested time in prison can fill you in on the facts of prison life, yet criminal fees commonly have a a lot more corrective impact that lots of people fail to think about.

Offender charges can likewise lug extra civil fines (well beyond what is common for civil tax issues). These are just some examples of the damage that also simply a criminal fee can bring (whether or not a successful conviction is ultimately acquired). My factor is that when anything potentially criminal emerges, also if you are simply a prospective witness to the issue, you need a seasoned IRS attorney to represent your rate of interests against the prosecuting company.

Some may quit short of absolutely nothing to acquire a conviction. This is one instance where you always need an IRS attorney seeing your back. There are several components of an internal revenue service lawyer's job that are apparently regular. A lot of collection matters are handled in click to find out more approximately similarly (although each taxpayer's situations and goals are various).

Some Of Matthew J. Previte Cpa Pc

Where we gain our stripes however gets on technical tax obligation issues, which placed our complete capability to the test. What is a technological tax issue? That is a hard concern to answer, yet the best method I would describe it are matters that need the specialist judgment of an IRS lawyer to solve effectively.

Anything that has this "reality dependency" as I would call it, you are mosting likely to intend to bring in a lawyer to seek advice from - tax attorney in Framingham, Massachusetts. Even if you do not keep the solutions of that lawyer, a professional point of view when handling technical tax obligation matters can go a long way towards understanding problems and settling them in a suitable way